The Galician Gang, Apple Computer and James Jesus Angleton

From around the 1790s, the imperial European militaries began to open themselves up to non-aristocrats and ethnic or religious minorities like the Galician Gang. In Austria, members of this gang could enlist as soldiers, officers or become military suppliers. This mattered because being an officer was a socially prestigious position with access to the court and massive procurement monies. The Galician Gang was particularly good at working these angles in Austria-Hungary and, until the Redl Scandal, this government-organized crime partnership seemed like good spycraft.

A similar situation unfolded in the United States during WWI. You can read about Leon Goetz, the Chess Family and the Goldman family in this post. This organized crime network rose to power on the back of stealing from/contracting with the US military and eventually they went into the computer gaming business with CIA head William Egan Colby. Prior to that, the mobsters went into business with OSS “active measures” operative James Jesus Angleton, the subject of this post.

Angleton’s father fought under General Pershing, Teddy Roosevelt’s “Rough Riders” partner. I wrote about the Rough Riders with respect to British Intelligence agent William Wesley Young. When his fighting days were over, Angleton Sr. managed National Cash Register’s Italian subsidiary. NCR made those gorgeous cash registers you may have noticed in period dramas.

A National Cash Register machine. At their peak, NCR had captured 95% of the US cash register market and were targeted by anti-trust forces. Like all the most powerful monopolies, NCR and its controlling investor John H. Patterson had the political protection to prevent enforcement of rulings against the firm. When NCR went public in 1922, its IPO was the largest in US history ($55 million in stock sold).

Patterson was not the technical genius behind the registers, the Ritty brothers (a pair of tavern owners) were, however Patterson was a sales-force genius. He trained and incentivized salesmen generously and one of these salesmen, James Hugh Angleton, ended up purchasing Patterson’s Italian franchise and owning a stake in NCR thereby. That is why James Jesus Angleton spent his teenage years in Italy and could befriend the Wisconsin poet Ezra Pound there.

Another one of Patterson’s star salesmen was Thomas J. Watson. Having been burned by the anti-trust action against NCR, Watson went on to lead what became IBM. This was the beginning of a long relationship between IBM and the Angleton family. James Angleton would turn to IBM immediately on his return from Italy to computerize the CIA’s “registry” for collecting information. By 1969 the CIA’s HYDRA program, which sucked in data from the NSA, FBI, Army Intelligence and other government agencies, ran on an IBM mainframe. (Rowan, Technospies, pages 66-70.) The early social history of IBM is the early social history of the surveillance state. Unfortunately for IBM, that social history took an underworld turn.

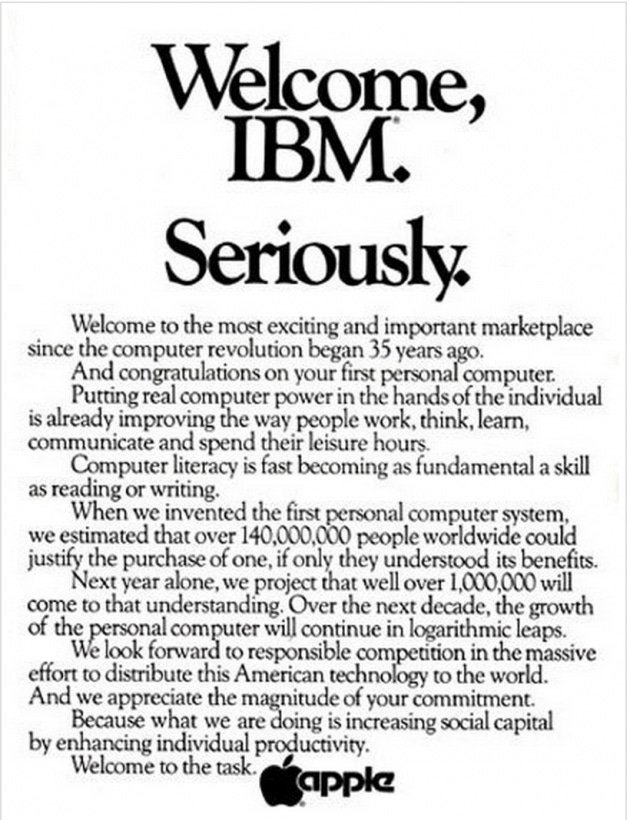

In 1981, immediately after Apple Computer’s shaky IPO, Angleton’s ally IBM decided to enter Apple’s small computer market with the “personal computer”. This angered Steve Jobs so much that he ran the following ad in The Wall Street Journal:

So in 1981, in the dim pre-dawn of the small business computer age, we have two companies duking it out to “distribute this American technology to the world”.

When Edward Snowden began to talk about NSA back doors to American private-sector technology products, IBM came out relatively unscathed— suspiciously unscathed. Certainly there is strong evidence to suggest that IBM’s Lotus Notes had an NSA “back door”, the encryption key to which is allegedly given here by cryptographer Adam Back. If you wanted to spy on really valuable legacy business and infrastructure systems, IBM would be more useful than Apple… or Facebook or anything FANG. Just saying.

So back to my point, Apple and IBM were duking it out to distribute “American” technology to small businesses and homes everywhere. Technology that was a scaled-down version of what IBM had spent decades selling overseas to tabulate valuable Doomsday Book economic information.

In 1978, two years prior to this fight, CIA director Bill Colby wrote his book Honorable Men which he concluded by extolling the merits of a global information sharing network for his intelligence community. Please also bear in mind the uncomfortable intelligence connections between Apple Gurus, Beatles Gurus and Rolling Stones Gurus. Remember the type of fish with whom we are swimming. Why did the sharks attack each other in 1981?

My answer in this post is that Apple vs. IBM ‘81 has everything to do with the internecine war which afflicted the US intelligence community, a brawl which became public in the 1970s. What readers will see is that Apple Computer is largely a Galician Gang undertaking and that Angleton’s IBM was far more “T.S. Eliot”. So let’s get into some corporate history.

When Watson first came to IBM, the company was a Frankenstein creation of other firms. At least one of these original founders became a major shareholder in the new IBM: George Winthrop Fairchild. This made George Fairchild both powerful and wealthy, which in turn helped his son Sherman Mills Fairchild to found Fairchild Semiconductor. However, Sherman Mills didn’t play by the gentlemens’ code. Sherman staffed his semiconductor concern by pilfering rebellious top talent from Shockley Semiconductor Laboratory. This pilfering was bitter and the defecting talent became known as “the Traitorous Eight”. The Eight really struggled to find funding after crossing Shockley and S.M. Fairchild exploited that void, while no doubt alienating Shockley’s supporters. The “Traitorous Eight” were atomized within their professional community and vulnerable.

William Shockley had set his firm up equitably with talent from Bell Labs and the military contractor Raytheon, while his funding came from a true genius, Arnold Beckman. Beckman was a Caltech professor and, by any account I can find, he was an honorable man. Beckman, with the blessing of his employer, did secret military work for the US government on things such as the Manhattan Project and radar development. Beckman’s wealth came from electronic instruments for measuring chemical concentrations, instruments which he designed himself. He and his wife became philanthropists underwriting education in the sciences, particularly chemistry. They never had anything to do with they type of socialism that was popular among some US-based millionaires during their lifetime.

Arnold Beckman was born in Cullom, a small farming village in central Illinois. In 1918 he met his wife, Mabel , while she was working in the dinning hall of a YMCA.

Shockley’s legacy is overshadowed now because he supported eugenics, but eugenics appealed to the socially responsible among the “T.S. Eliot” crowd precisely because it was a scientific solution to the problem of human suffering. What this crowd looked down upon was dishonor. Dishonorable behavior by employees— like that of the Traitorous Eight— marked them as bad investments for the future. Trust was key. Just as Brooklyn novelist Richard Elman observed, the T.S. Eliot crowd’s culture was one steeped in Christianity, albeit imperfectly expressed.

A similar “Traitorous Eight” rupture happened at Sperry Rand Corp and this resulted in the founding of National Semiconductor. Sperry made gyroscopes for guiding aircraft and bombs. In the 1950s they partnered with IBM to produce computers. Seven Sperry employees left in 1959 to found National Semiconductor, which resulted in Sperry bringing suit for patent infringement. The suit went on for years and to stay afloat National had to take on debt from “pair of West Coast investment firms and a New York underwriter.”

This matters to Apple, because Don Valentine and Mike Markkula both came from Fairchild Semiconductor, while Michael Scott came from National. These are the three men who made Apple Computer, and their teeth were set on edge against that “T.S. Eliot” pool of capital behind IBM. Enter Atari Corp.

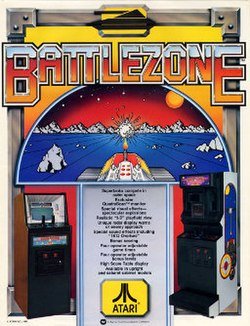

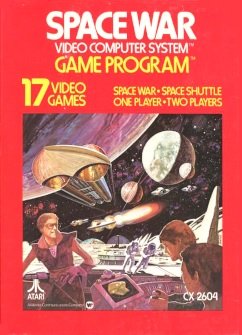

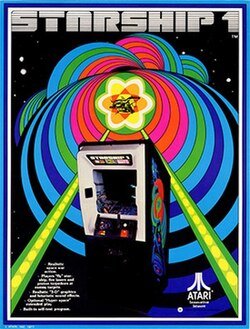

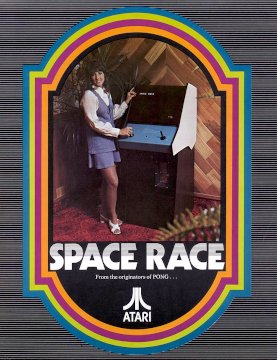

Atari was started by a Mormon kid who partnered with Chicago and Las Vegas organized crime networks, specifically, mob gambling undertakings. Steve Jobs worked for Atari when he decided to start Apple Computer: he used Atari materials and his Atari boss helped him find National Semiconductor and Fairchild Semiconductor investors who were also the key Apple management. In fairness, Apple Computer ought to be considered as a spin-off of Atari.

Let’s break this history down from the beginning. Atari was founded by Nolan Bushnell (the Mormon kid from Utah) and a US Marines Corp-trained electrical engineer named Ted Dabney. From 1968 both young men were employed by AMPEX, Dabney (at least) in the firm’s military products division.

AMPEX, which stands for Alexander M. Poniatoff Excellence, was named after its Russian founder and existed solely to profit from sound recording technology stolen from Germany after WWII. Why Poniatoff should profit from this theft, rather than the families of US soldiers who sacrificed everything for the war, remains unclear to me. What is clear is that Poniatoff was a military technology contractor who also produced recording equipment for California’s shady music industry. (Please see my posts on Ram Dass, The Rolling Stones and Andrew Loog Oldham.)

In 1972 Bushnell and Dabney struck out on their own to build arcade games based on amusement park ideas Bushnell hit on back in Utah. These early ideas drew heavily from aliens/UFO-culture. In order to produce and market the games effectively, the pair went into partnership with Bally Manufacturing, the outfit which made slot machines for the Las Vegas mob-casinos.

In the 1930s slot machines and coin-operated arcade games were, like their predecessors nickelodeons, the type of morally dubious entertainment that one might find in saloons or outside movie theaters— the type of place Galician groomers would recruit kids, or prostitutes would pick up punters. The history of coin-operated entertainments is bound up with that of the music industry and ‘big three’ ethnic mafia partnerships: Galician, Irish, Italian. Bally Manufacturing, named after a “proto-Playboy style” Chicago magazine titled Ballyhoo, was the top supplier of coin-operated machines in this sleazy mob industry. Bally got its start making punch board gambling machines.

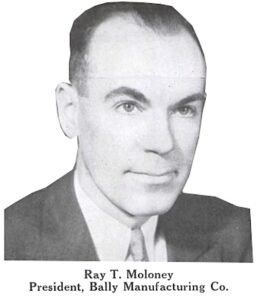

The man who put Bally at the top of the gaming industry was Raymond Thomas Moloney, as described by the Made in Chicago Museum:

A practical jokester with an amiable Irish charm, Ray made friends with ease, and it helped him plot his course. After just a couple years working for the Joseph P. Linehan Printing Company, his bosses liked the cut of his jib enough to put him in charge of two new subsidiary businesses. The first—launched in 1922—was the Lion Manufacturing Company, which focused on producing “punch boards,” the low-budget trade-stimulators that were basically the unregulated scratch-off lottery tickets of their era. Three years later, the Midwest Novelty Company was established to distribute all of the prizes or “premiums” associated with the punch board business—usually little things like pocket knives and wallets. By the end of the decade, Midwest Novelty had also become a distributor for some bigger-ticket items, including gaming machines—thus introducing Ray Moloney to the wider world of coin-operated entertainment.

Moloney went into partnership with David and Solomon Gottleib of D. Gottlieb & Co. in order to expand his gaming business and turn Bally into a “Mishawum Marriage” company— the type of concern worthy of Chicago’s organized crime gambling heritage.

“Though not necessarily thought of as a “gaming destination” a la Vegas or Atlantic City, Chicago was the undisputed hub of coin-op (and gambling related) manufacturing for much of the 20th century. Most of the biggest producers of pinball machines—including Gottlieb, Williams, and Stern—were Chicago-based, and before World War II, the same could be said of the slot machine industry, as the Watling MFG Co., Mills Novelty Co., and Jennings & Co. all operated here, along with future jukebox leaders Rockola and Seeburg.”

Gambling was the top business of the Kentucky Colony, Chicago’s gangland overlords, until the 1890s when prostitution overtook gambling to fund their political corruption. That doesn’t mean they exited gambling, though. In fact, we in Monroe, WI had our own problems with Chicago “punch board” gambling machines thanks to Leon Goetz. Leon was busted for such arcade gambling just a few months prior to being indicted for White Slaving, see my post on Leon’s Mann Act indictment.

From The Monroe Evening Times newspaper, September 22nd 1920: “Leon Goetz pleaded “nolle contendere” to charge of operating a gambling device when arraigned in court before Justice M. E. Baltzer today. In common street language his lea meant “It may be true and it may not, I won’t argue with you.” The court then fined Mr. Goetz $10 and costs and dismissed a similar charge against Chester Goetz, brother of Leon who is associated with him in the operation of the Lobby Lunch (unclear). District Attorney Caradine charged the Goetz brothers had been operating a punch board in violation of the state law.”

Leon, a small-time vice profiteer, was following the lead of the powerful local Ludlow family (to whom Leon probably owed money) and their Civil-War-era Bonelatta Gang partners. The gang’s Irish mafia alters in Janesville, who were operators of the repulsive child-grooming den “The European Hotel”, were also gambling dons:

Janesville Daily Gazette, April 20 1905.

Readers may remember that the Bonelatta Gang were the Green County, WI wing of Chicago’s Kentucky Colony, whose gambling operations touched on the most illustrious Chicago connections, such as that of the McCormick family.

From the Inter-Ocean newspaper, Chicago.

Between 1860-1890 at the street level, Chicago’s gambling scene was controlled by Irish mobsters like Mike McDonald and Lincoln-aligned Black mobsters like Mushmouth Johnson. They were displaced around the time of the Columbian Exposition by Galician and Italian counterparts.

Therefore, what Moloney and the Gottliebs were doing had a long history, a sad history which reaches to the heights of Chicago wealth and politics. A history which could only result in what Chicago has become today. (Check out Lincoln’s Counterfeiters, out October 2025.)

With mob connections like those described above, it was only a short time before Bally Manufacturing got caught in an illegal gambling sting. This happened in 1941:

Cautious or not, the Bally MFG Company was implicated in 1941—along with Mills and several other Chicago manufacturers—for selling carloads of slots machines directly to one of the city’s most notorious gambling syndicates, led by longtime Al Capone crony Jack “Greasy Thumb” Guzik. America’s entrance into World War II largely helped bury that story just a few days later, but Ray Moloney still took the step of employing a former Secret Service agent, Tom Callaghan, as a personal aide in the years that followed.

Very lucky it happened in 1941 too, because the Office of Naval Intelligence were working out a deal with the imprisoned Charles “Lucky” Luciano to employ his mafia agency as a Pinkerton-like outfit to patrol the USA’s docks and other transportation networks. Soon the OSS (James Angleton) would partner with the same mafioso to assist in the invasion of Italy. (Mussolini cracked down on organized crime and cut into Luciano’s, Meyer Lansky’s and Bugsy Segal’s profits.) Bally Manufacturing could shake off that little Capone problem by “giving the Axis the Axe”.

What did that look like? Gaming amusements for soldiers— not unlike the Navy’s porn problem I wrote about a few years ago. FDR’s and Navy head Josephus Daniels’ policy was to shut down the bordellos and subsidize the pornographers. Now they would shut down illegal gambling rings and subsidize the arcade game industry.

From the Made in Chicago Museum:

Bally had already taken on some government contracts for the Allied cause before Pearl Harbor, and by January of 1942—a month after the U.S. officially entered the war—Ray Moloney announced more defense contracting on the way, but also a firm commitment to keep making gaming machines. “Plans are being rushed to convert additional Bally production lines to Uncle Sam’s big job of giving the Axis the Ax,” he said. “Along with our war work and consistent with our industrial duty, we will, of course, continue to serve the American operators—who, in turn are serving America by providing the convenient, low-cost recreation so vital to morale.”

Moloney might have been resistant to shift 100% of his factory strength to defense contracts at first, but by 1943, that’s exactly what had happened—and it actually proved more profitable and beneficial to Bally’s reputation than he might have expected, beginning with the government-aided expansion of the Belmont Avenue plant to 125,000 square feet.

Keeping things in the family once more, Ray put his younger brother George Moloney in charge of much of the war production effort, while on the promotional end, Herb Jones called on the public to “Buy U.S. War Bonds!”

As a credit to the considerable contributions that Lion MFG / Bally made to the fight, they were bestowed with an Army-Navy “E” Flag award in 1943, presented at a ceremony in Chicago that October. George Moloney was ill at the time and couldn’t attend—days later, he died from surgery complications at the age of just 36.

Quite naturally, Moloney and the Gottliebs took the Navy money and ran with it by branching out into electronic arcade video games, readers may remember the potty-mouthed Gottlieb creation “Q*bert”. This is the genesis of the technological, manufacturing and marketing expertise which Bally brought to Atarti in order to make Atari a success.

Readers will remember that Atari founder Nolan Bushnell hired Steve Jobs, whose father Abdulfattah John Jandali ran the Boomtown Casino in Reno, NV and was therefore an important patron of Bally products.

Steve Jobs’ dad’s casino in the 1960s. Thank you, Casino Chip and Token News, April-June 2004

Atari has more than one mafia patron, though. In 1976 Atari was bought by Warner Communications, which was an outgrowth of the Galician mob in New Jersey.

Warner Communications started as Kinney Parking Company, owned by Emmanuel “Manny” Kimmel, son of Austrian Jewish immigrants and gambling business partner to mobster Abner "Longie" Zwillman, son of Lithuanian Jewish immigrants. In the 1930s Zwillman ran a Pinkerton-like operation in New York and New Jersey whereby paid thugs would terrorize pro-German political gatherings: an ancient line of business for the Galician Gang in Austria-Hungary and London’s theater scene. Kimmel and Zwillman were longtime associates of Charles Luciano and Meyer Lansky, the ONI and OSS assets, whose organized crime profits suffered under the fascist Italian government.

Kinney Parking Company was incorporated in 1945 by Manny Kimmel. In 1961, Kimmel merged his company Kinney with the business of car rental/funeral home/cleaning agency entrepreneur Edward Rosenthal. The new entity was renamed Kinney Service Corporation and taken public. Another merger was engineered with Louis Frankel’s National Cleaning Contractors, Inc. and the resulting firm was called Kinney National Company. Steve Ross, who had married Rosenthal’s daughter Carol, became Kinney’s CEO and began buying up a portfolio entertainment companies: National Periodical Publications (the predecessor to DC Comics) and Ashley-Famous (a talent agency) in 1967, Panavision, Inc. (a film camera company) in 1968, and “Warner Bros.-Seven Arts” in 1969 which it renamed “Warner Bros Inc.”

In the early 1970s Kinney National Company divested itself from the funeral, car rental, cleaning and parking concerns to focus on entertainment. In Febuary 1972 it renamed itself “Warner Communications” and went public on the NYSE. Steve Ross remained CEO, while undertaker Edward Rosenthal would serve as Executive Vice President (EVP). Beyond Warner Bros Inc. and the previously listed firms, the conglomerate’s holdings included Warner-Elektra-Atlantic; Warner Books; a European publisher called Williams Publishing; Television Communications Corporation (Warner Cable); and soccer team called New York Cosmos. Ross bought Atari in 1976, which is also the year that Ross’s new employee Bushnell took a very paternal interest in Steve Jobs.

In 1976 Bushnell made sure that Atari resources were available to Jobs and (particularly) Steve Wozniak to prototype their “Apple I”. Then Bushnell organized Jobs’ meeting with Sequoia Capital Management and Apple’s soon-to-be top executives, the magic men from Fairchild and National Semiconductor.

The most magical of these unicorns was Armas Clifford "Mike" Markkula Jr., a 33 year old millionaire from Intel and Fairchild Semiconductor stock options, to whom Sequoia’s Don Valentine (a Fairchild and National alum) passed Jobs after deeming Apple Computer too risky. Mike got Apple functional with Bank of America money and Valentine/Sequoia came in to invest later. (Why Bank of America? See below.) Because the 23 year old Jobs was not qualified to be Apple’s CEO, Makkula recruited National Semiconductor alum Michael Scott for that role. Bearing in mind the reality of who made what work, Apple Computer begins to look very much like a Galician-mob-funded spin-off from the bitter men at National Semiconductor. (National Semiconductor would even buy Fairchild in a few years’ time.)

In 1981 Markkula decided to take the firm public with an ambitious IPO: the stock was overpriced by crazy multiples. The lucky investment firms who shepherded this IPO were Morgan Stanley and a little-known, 13-year old firm Hambrecht & Quist. Although H&Q were 1/50 the size of Morgan Stalney, they had special pull as Fortune magazine told it in 1981: “when it comes to financing small high-technology companies like Apple, Hambrecht & Quist has a special touch.” Later H&Q IPOs were Genentech, Adobe Systems, Netscape, MP3.com, Salon, Winetasting, Salesforce, Asiacontent and Amazon.com. (I talked about Salesforce with the Steve Jobs gurus.)

Hambrecht & Quist was run by one William R. Hambrecht, who since the 1970s has been a good friend of Nancy Pelosi, the best investment manager in America. When Hambrecht isn’t starting up Silicon Valley legends, he’s building the California Democratic Party’s candidate roster. But I get ahead of myself…

Hambrecht was a University of Chicago graduate from Long Island who ran Francis I. DuPont & Co.’s investment banking office in San Fransisco. That’s “DuPont” as in the Delaware military contracting family. Hambrecht managed personal wealth and regularly beat the newspapers trying to drum up clients. Advertising to small-time (low information) investors through "mass circulation magazines and newspapers" was founder F. I. DuPont’s key strategy; it was also the Ringstrasse investment banks’ strategy before the Austro-Hungarian financial collapse of 1873, which implicated the Emperor’s newspaper-mouthpieces. This economic downturn signaled the beginning of the end for the Vienna-based Ringstrasse.

The San Fransisco Examiner, May 31, 1966.

Francis I. DuPont’s “small investor” strategy was a victim of its pre-computer success. The firm’s operation costs doubled in the late 1960s as they were overwhelmed with the cost and paperwork of small trades. They decided to merge with Hirsch & Co., which was an investment firm run by J. W. Seligman & Co. partners/family members. andreanolen.com readers know the Seligmans from William Wesley Young’s astroturfing the WWI era socialist movement. In 1970 (i.e. just a few years later) DuPont, Hirsch would merge with Chicago-focused British bank Glore Forgan, which counted Kentucky Colony offspring Marshall Field III as one of its partners, while J. Russell Forgan, the son of its (British) founder, was an old OSS man. This new tri-glomerate would hide the “Hirsch” name and call itself “F.I. duPont, Glore Forgan & Co.” It was during this tumultuous period that Hambrecht left to start his own investment firm, Hambrecht & Quist.

Hambrecht made a good call. All this merging didn’t save F.I. duPont, Glore Forgan & Co. By the end of 1970 a former IBM salesman named H. Ross Perot sailed in and bought up the investment firm. Perot had alienated IBM by hurting computer sales. Perot’s computing resource management company, Electronic Data Systems, allowed IBM customers to farm out or minimize their hardware needs. “Perot was tempted by the possibility that EDS could become the computer service provider for Wall Street and saw the possibilities of duPont being his entrée into the field.”

Perot’s entry was contentious and President Nixon’s administration had to engineer truce talks between Perot and the DuPont family. Peace came when Perot and the DuPonts agreed to invest heavily in each other’s separate business ventures— the two camps married.

With Perot came another bank that Perot had recently purchased: Watson & Co. Watson was in trouble with the SEC because it didn’t disclose that it was actually controlled by Bank of America owners, the San Fransisco Giannini family into which the founder, Vernon C. Watson, had married. The Gianninis built their empire serving as bankers for Italian immigrants and their holding company, Transamerica Corporation, would end up owning United Artists, gangster Charlie Chaplin’s film production and distribution company. Perot bought Watson & Co. so that his computer service company could manage its financial transactions. (And slash the operating costs which had sunk the DuPonts, Hirsches (Seligmans), and William Stephenson cronies.) While Perot bought the bank, he didn’t buy the clients the bank served, which probably explains the connection between Apple Computer, Bank of American and H&Q.

I want to impress onto readers what type of people these were. Vernon Watson shot himself in 1964 because his firm was not allocated enough shares to sell as part of the Communications Satellite Corporation, known as COMSAT, IPO. (COMSAT is sort of “Elon Musk” venture set up by President Kennedy.) Politics decides how shares are distributed between brokers.

The Perot/DuPont marriage floundered and in 1974 Perot abandoned the undertaking, letting the company die. Ross Perot’s involvement in San Fransisco finance left Hambrecht with interesting new contacts. He became a board member for Granger Associates, a microwave device manufacturer for the US military and the Government of Iran… after the Gianninis’ Bank of America saved Granger from that bad choice.

The San Fransisco Examiner, Dec 12, 1979.

Hambrecht also became director of INFOMAG, another high-tech component manufacturer for the US military, the management of which had just been convicted for exporting technology to Eastern Europe without the appropriate licensing. (See Santa Barbara News-Press, June 26 1978 page 12.) But perhaps most importantly for Apple Computer, Hambrecht was in 1976 elected to the board of the National Association of Securities Dealers. When Apple went public in 1981, Irish-American politicians in Boston prevented the stock being traded in Massachusetts because it was overvalued— a noble bout of conscience. Deft manuevering from the NASD overturned that objection in a matter of days.

The San Fransisco Examiner, Dec 16, 1980.

I’m going to end this troubling post by looking at the very troubling dealings Hambrecht had with the late 1980s Savings & Loan Scandal, which wiped out one third of these financial institutions. Institutions which typically served older people and the financially unsophisticated. People who couldn’t afford to lose the money.

Here’s how the problems started. The Savings and Loan industry was built to provide low-cost home ownership loans for working people. They were run conservatively until the early 1980s when the Federal Reserve attempted to sell more government debt by raising interest rates, thereby causing inflation. This is Lincoln’s national banking system bringing home the "universal financial unsoundness”— read all about the national bank boondoggle in my book Lincoln’s Counterfeiters, out Oct 2025.

Savings and Loan lenders couldn’t match Uncle Sam’s returns. (S&Ls couldn’t print money!) Therefore, two evil geniuses introduced finance-industry-backed legislation to deregulate the S&L industry, allowing financial crooks to buy the firms en masse and prostitute their ‘under-leveraged’ asset portfolios. These evil geniuses were a Democrat from Rhode Island named Fernand St Germain (“I’m no saint” Germain) and the Mormon Mayor of Salt Lake City, Republican Senator Jake Garn.

Utah senator Jake Garn was asked to participate in a space flight because he was head of the Senate appropriations subcommittee that dealt with NASA. An untrained astronaut, Garn’s space sickness was so severe that his handlers at NASA began to informally measure space sickness in “Garns”.

"Oral History 2 Transcript" (PDF). Johnson Space Center Oral History Project. NASA. May 13, 1999. pp. 13–35. Retrieved April 22, 2011. [Dr. Robert Stevenson:] “Jake Garn was sick, was pretty sick. I don't know whether we should tell stories like that. But anyway, Jake Garn, he has made a mark in the Astronaut Corps because he represents the maximum level of space sickness that anyone can ever attain, and so the mark of being totally sick and totally incompetent is one Garn. Most guys will get maybe to a tenth Garn, if that high. And within the Astronaut Corps, he forever will be remembered by that.”

Toying with either credit unions or savings and loans— that section of the financial industry which served low-income people— became something of a hobby for permanent Washington after WWII. In the 1960s President Lyndon Johnson’s Office of Economic Opportunity, lead by Maria Shriver’s dad, tried to encourage Black business ownership. It did encourage some Blacks, notably Lawrence E. King Jr. of the Franklin Community Federal Credit Union. In the 1980s King managed his government-subsidized credit union in the same way criminal investors exploited the then-deregulated Savings and Loan industry. As a result, Franklin blew up at about the same time the exploited 1/3 of the S&L sector did: late 1980s.

Larry King was a good friend of G. W. Bush and well connected in the Republican Party. The same was true of Carl Linder Jr. who shared Larry King’s investment philosophy. Instead of using a credit union, Linder used the deregulated S&L market in Southern California. Linder had his lackey Charles Keating defraud the Lincoln Savings and Loan in a massive debt scheme which robbed a bunch of seniors of their savings.

Karl Linder Jr. shared similarities with Lawrence E. King Jr. Linder made his money insuring large agricultural concerns. King got his credit union because his father was a tame union rep for a large agricultural concern. Read all about the Beef Trust in Lincoln’s Counterfeiters!

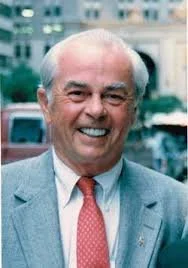

Fortunately for Linder, Bill Hambrecht helped elect a Californian democrat senator who was soft on financial crime: Alan Cranston. Cranston was head of the “Keating Five”— senators hell-bent on protecting Keating from suffering the consequences of his actions. Senators interfering with a criminal investigation of financial crime.

The Sacremento Bee, Jan 21 1982. Page 3.

Thanks to financial wizard Hambrecht, Alan Cranston, along with three other democrats and John McCain, were on hand to defend crooked money-men by any means necessary. I wonder if creeps like Larry E. King Jr. and Keating felt safer knowing that Cranston, McCain etc were in the Senate?

So, beyond the depressing reality that organized crime took over a good chunk of the US economy after Luciano went into business with the ONI/OSS/CIA, what can we take home from the history of Apple Computer?

Perhaps we shouldn’t expect good results to come from bad deeds.

The truth shall set you free. Be not wise in your own eyes; fear the Lord and shun evil. (Proverbs 3:7)